Strategic New Value Opportunities, 2025-2028: A Consulting Roadmap for Growth

As businesses navigate an increasingly complex, technology-driven marketplace, the next three years will present unprecedented opportunities for organisations willing to embrace transformation. The convergence of artificial intelligence, sustainability imperatives, digital acceleration, and evolving consumer expectations is creating new value pools that forward-thinking companies can capture through strategic internal optimisation and external market positioning. This report examines the most commercially promising business opportunities through 2028 and provides actionable frameworks for capitalising on them through both internal initiatives and external expansion strategies.

1. Executive Summary: Key Opportunities and Strategic Imperatives

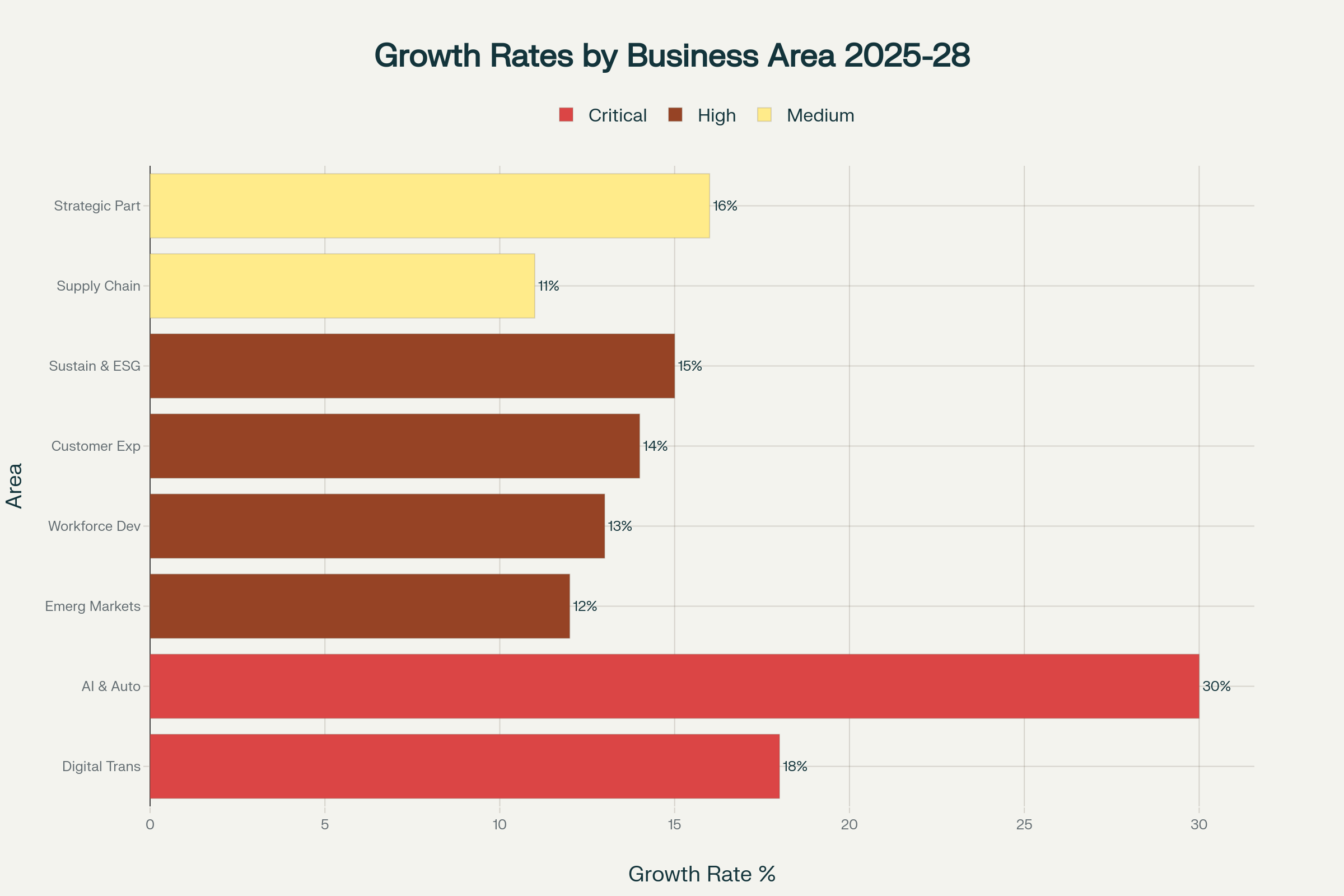

The business landscape from 2025 to 2028 will be defined by eight critical opportunity areas that collectively represent over $3 trillion in potential value creation. Artificial intelligence and automation lead with a projected 30-37% compound annual growth rate (CAGR), followed by digital transformation at 18% and strategic partnerships at 16%. Organisations that successfully integrate internal capability building with external market expansion across these domains will gain sustainable competitive advantages. The most successful companies will adopt a dual-focus strategy: investing in internal process optimisation, workforce development, and technological infrastructure while simultaneously pursuing external opportunities through new product development, market expansion, and ecosystem partnerships.

Projected growth rates for the most commercially promising business opportunities over the next three years, showing AI & Automation leading at 30% CAGR

2. Artificial Intelligence and Automation: The Primary Growth Engine

2.1 The Market Opportunity

Artificial intelligence represents the single most transformative business opportunity of the next three years, with the global AI market expected to reach $826.70 billion by 2030, growing at 30-37% annually. Nearly 90% of business leaders now view AI as fundamental to their company's strategy, marking a decisive shift from experimental technology to essential infrastructure. This creates dual opportunities: organisations can leverage AI internally to drive 20-30% productivity gains while simultaneously developing AI-enabled products and services for external markets.

2.2 Internal AI Initiatives

Internally, businesses should prioritise AI-powered process automation to achieve measurable operational improvements. Organisations implementing comprehensive automation strategies report 60% reductions in manual task time, 40% improvements in process efficiency, and significant decreases in human error rates. The ROI calculation is compelling: companies investing $100,000 in automation typically generate $150,000 in net benefits within the first year, yielding 50% returns. Financial services firms have reduced customer onboarding time from seven days to 24 hours through automated document verification and intelligent routing, while healthcare providers have increased daily patient capacity by 25% through AI-driven scheduling and triage systems.

Decision intelligence represents the next evolution, where AI doesn't merely provide insights but directly initiates actions based on predictive analytics. Supply chain systems can automatically initiate orders with optimal quantities based on predicted sales volumes, weather patterns, and transportation costs. At the same time, marketing platforms can dynamically adjust campaigns based on real-time performance data. To maximise internal AI adoption, organisations must conduct thorough process audits to identify high-volume, repetitive, error-prone processes as initial targets for automation, ensuring quick wins that build momentum for broader transformation initiatives.

2.3 External AI Market Positioning

Externally, the AI consulting and implementation services market presents substantial opportunities, particularly for organisations with technical expertise. Businesses struggle to integrate AI effectively despite recognising its importance—this gap creates demand for consultants who can bridge outdated processes and modern technology. Specialising in specific industries such as healthcare, finance, or retail allows consultants to build deep expertise and become go-to advisors for AI transformation. The most successful AI service providers combine technical implementation with change management capabilities, addressing both the technology and cultural dimensions of AI adoption.

AI-powered content creation services represent another lucrative external opportunity, as businesses ramp up their online presence while maintaining quality and efficiency. Providers offering "AI-first, editor-refined" content packages that use tools like ChatGPT and Jasper for first drafts, then refine for tone, accuracy, and SEO, command premium rates while enabling clients to scale content production sustainably. The key differentiator lies not in raw AI generation but in the human editorial layer that ensures brand consistency, factual accuracy, and strategic alignment.

3. Digital Transformation and Infrastructure Modernisation

3.1 Strategic Foundations for Digital Success

Digital transformation, growing at 18% CAGR, extends far beyond technology implementation to encompass fundamental business model reinvention. The most successful digital transformations begin with clear alignment on business objectives—specifically, how digital capabilities will advance 5-10 year strategic goals rather than simply modernising existing processes. Organisations that lead with business priorities rather than technology specifications achieve significantly higher success rates, as transformation becomes strategically positioned rather than treated as isolated IT projects.

3.2 Internal Digital Initiatives

Internally, businesses should prioritise data infrastructure and analytics capabilities as foundational digital investments to ensure data governance. Companies leveraging big data analytics to create a competitive advantage gain unique insights that help them seize business opportunities, optimise operations, reduce costs through predictive analysis of customer behaviour, and enable real-time forecasting for rapid market adaptation. Amazon and Netflix exemplify this approach, analysing vast customer datasets to optimise services and content, setting standards for data-driven success that businesses of all sizes can now emulate through accessible platforms.

Cloud migration and platform modernisation enable the flexibility and scalability essential for digital-first operations. Organisations moving to cloud architectures reduce infrastructure costs while gaining the ability to scale resources dynamically, experiment with new services rapidly, and integrate emerging technologies more seamlessly. The implementation should follow phased approaches: starting with pilot programs in specific business units, scaling and refining based on results, then full deployment with comprehensive change management support.

3.3 External Digital Market Opportunities

Externally, the e-commerce and digital retail sector continues to expand at a 14-21% CAGR despite post-pandemic maturation, driven by AI personalisation, influencer-driven sales, and seamless mobile experiences. India's e-commerce market alone is growing at 18.7% annually, while global markets are maintaining double-digit expansion. For marketers, UX designers, logistics professionals, and entrepreneurs, this represents a sustained opportunity in platform development, customer experience optimisation, and omnichannel integration.

Digital health and telemedicine present particularly compelling external opportunities, with the sector growing at 18-25% CAGR. The post-pandemic normalisation of digital-first healthcare creates demand for wearable technology platforms, remote monitoring systems, AI diagnostics tools, and integrated care coordination platforms. Professionals operating at the intersection of technology and healthcare can capitalise on this convergence through solutions that make care more accessible, affordable, and personalised.

4. Sustainability, ESG, and the Green Economy

4.1 The Business Case for Sustainability

Sustainability has evolved from corporate social responsibility to core business strategy, with the green economy presenting 10-17% annual growth opportunities. The transition stems from regulatory mandates, investor pressure, and genuine consumer preference shifts: 55% of consumers now willingly pay premiums for eco-friendly brands, while sustainable brands enjoy 34% customer loyalty compared to 27% for conventional alternatives. By 2026, the European Union's Corporate Sustainability Reporting Directive (CSRD) will require multinational companies to report their 2025 sustainability data, creating both compliance imperatives and opportunities for competitive differentiation.

4.2 Internal Sustainability Initiatives

Internally, organisations must move beyond fragmented sustainability programs to scaled, integrated ESG strategies embedded across entire operations. This requires detailed transition plans spanning 20+ years that credibly demonstrate contributions to limiting global warming to 1.5°C, with companies facing heightened financial, market, and legal risks if they are unable to substantiate their climate commitments. Leading organisations like Siemens and Decathlon focus on scaling circular business models that align profitability with environmental impact, moving from experimentation to company-wide execution.

Renewable energy integration and energy efficiency programs deliver both cost savings and improvements in sustainability metrics. Organisations investing in solar power systems, energy storage, and smart grid solutions reduce operational costs while meeting decarbonisation targets. The UAE's plan to invest AED 200 billion in renewable energy and sustainability solutions to achieve net-zero emissions by 2050 exemplifies government support that makes such investments increasingly attractive.

4.3 External Green Market Opportunities

Externally, sustainable product development and circular economy innovations represent substantial market opportunities. Businesses creating biodegradable packaging materials, reusable product alternatives, sustainable fashion lines, and eco-friendly consumer goods tap into rapidly expanding market segments. The ecotourism market alone, valued at $248 billion in 2024, is projected to grow to $945 billion by 2034, demonstrating consumer willingness to pay for sustainable experiences.

Sustainability consulting services address the growing need for ESG expertise as companies struggle to develop credible sustainability strategies, improve environmental performance, and navigate complex reporting requirements. Consultants who help businesses adopt sustainable practices, improve carbon footprinting, and meet regulatory compliance requirements will find sustained demand as ESG transitions from voluntary to mandatory across major markets.

5. Customer Experience Transformation

5.1 The CX Value Proposition

Customer experience has become the primary competitive battleground, with 89% of businesses now competing primarily on CX—a sector projected to reach $52.54 billion by 2030. The strategic importance stems from quantifiable business impacts: CX enhancements can increase sales by 2-5%, facilitate cross-selling, and add 5-10% to margins. Organisations that successfully measure and improve CX ROI achieve higher customer retention, increased lifetime value, and stronger competitive positioning.

5.2 Internal CX Initiatives

Internally, businesses should invest in CX analytics and measurement capabilities that quantify the return on customer experience investments. The basic ROI formula—(Total Financial Gain – Cost of Support) / Total CX Investment Costs × 100—provides frameworks for demonstrating value to CFOs and securing ongoing investment. Organisations implementing comprehensive CX platforms report 30% improvements in customer satisfaction scores alongside 15% increases in customer retention rates.

Journey orchestration and personalisation platforms enable businesses to deliver consistent, contextually relevant experiences across touchpoints. AI-driven recommendation engines, predictive customer service, and proactive engagement models transform reactive service into anticipatory experiences that delight customers and drive loyalty. The key lies in connecting CX initiatives to specific business outcomes—higher conversion rates, increased purchase frequency, lower churn risk—rather than treating customer experience as purely qualitative aspiration.

5.3 External CX Market Opportunities

Externally, CX platform development and consulting services meet growing demand from organisations seeking to improve customer interactions. Businesses that combine customer experience strategy with technology implementation—deploying platforms for feedback collection, sentiment analysis, journey mapping, and omnichannel engagement—create substantial value for clients while building recurring revenue models.

AI-assisted customer service solutions represent particularly high-growth opportunities. Companies developing or implementing AI-powered chatbots, virtual assistants, sentiment analysis tools, and predictive service routing help clients reduce service costs while improving customer satisfaction. The most effective solutions combine AI efficiency with human empathy, using automation for routine inquiries while seamlessly escalating complex issues to human agents.

6. Emerging Markets and Geographic Expansion

6.1 The Emerging Markets Opportunity

Emerging markets will grow at approximately 3.7% in 2025, outpacing advanced economies despite falling below historical 4% averages. The opportunity lies not in aggregate growth but in specific sectors and regions experiencing rapid development: Southeast Asia's internet economy will hit $600 billion by 2030, Africa's fintech sector will see the highest global revenue growth, and India's digital market continues to expand across online retail, fintech, and digital healthcare.

6.2 Internal Market Entry Preparation

Internally, successful emerging market expansion requires comprehensive market research and localisation capabilities. Organisations must understand consumer behaviour, purchasing power, unmet needs, regulatory complexity, and competitive landscapes before entering new geographies. This involves more than identifying GDP growth—businesses must evaluate ease of doing business, infrastructure quality, and cultural fit to select markets where their offerings resonate.

Partnership and alliance development capabilities are essential for emerging-market success. Local partnerships help navigate regulatory requirements, understand cultural nuances, build distribution networks, and establish credibility more quickly than wholly owned operations. Companies entering Southeast Asia, for instance, often partner with established regional players who provide market knowledge, customer relationships, and operational infrastructure that would take years to build independently.

6.3 External Emerging Market Opportunities

Externally, mobile-first digital services align with emerging-market consumer behaviour, particularly in regions with high mobile penetration but limited traditional infrastructure. Digital banking, mobile payments, e-commerce platforms, and digital education services that assume mobile-primary usage patterns capture expanding middle-class populations in Asia, Africa, and Latin America. The key lies in designing for mobile constraints—intermittent connectivity, data costs, device limitations—rather than simply shrinking desktop experiences.

Localised product adaptation creates competitive advantages in emerging markets where global products often fail to meet specific local needs. Companies that invest in understanding regional preferences, setting appropriate price points, and customising offerings for local contexts achieve higher success rates than those that deploy standardised global products. Consumer goods companies entering India and Southeast Asia, for example, develop smaller package sizes, local flavour profiles, and pricing strategies that align with purchasing patterns in these markets.

7. Strategic Partnerships and Ecosystem Development

7.1 The Partnership Advantage

Strategic partnerships have emerged as powerful growth accelerators, enabling companies to access new markets, share resources, mitigate risks, and enhance competitive positions without massive capital investments. Organisations leveraging strategic alliances achieve market entry 40-60% faster than those pursuing independent expansion, while distributing financial and operational risks across partnership structures.

7.2 Internal Partnership Capabilities

Internally, businesses must develop cross-functional collaboration frameworks that enable effective partnership management. This includes establishing partnership governance structures, defining clear roles and responsibilities, creating communication protocols, and implementing performance measurement systems that track partnership value creation. The most successful partnerships result from alignment on strategic objectives, complementary capabilities, and shared commitment to value creation rather than simply opportunistic deals.

Innovation ecosystem integration positions companies within networks of startups, corporates, universities, and government entities that collaborate on emerging technologies and business models. Corporate accelerators, venture client programs, and innovation districts create environments where established firms gain access to startup agility and innovation while startups receive market access and mentorship. The UAE, Singapore, and other innovation hubs demonstrate how sovereign investment, collaborative policies, and cross-sector partnerships create thriving ecosystems that benefit all participants.

7.3 External Partnership Opportunities

Externally, joint ventures for market entry enable companies to enter new geographies or segments with reduced risk and faster time-to-market. Technology companies partnering with regional telecommunications providers, for example, gain instant access to distribution networks and customer relationships that would otherwise require years to establish. The most effective joint ventures combine complementary strengths—one partner's product expertise with another's market knowledge—creating value neither could achieve independently.

Technology partnerships and platform ecosystems allow companies to extend capabilities without building everything internally. Software platforms that enable third-party integrations, API ecosystems that connect complementary services, and channel partnerships that expand market reach all leverage the network effect principle: value increases exponentially as the ecosystem grows. Organisations that build platform strategies, rather than purely product strategies, position themselves as central nodes in value-creation networks.

8. Workforce Development and Talent Strategy

8.1 The Human Capital Imperative

Workforce development has become critical, as the World Economic Forum forecasts that 59% of employees will need new skills by 2030, driven by technology adoption, automation, and changing business models that are disrupting traditional job requirements. Organisations that invest in upskilling achieve 94% higher employee retention, according to LinkedIn research, while simultaneously building internal capabilities that reduce dependence on expensive external hires.

8.2 Internal Workforce Initiatives

Internally, comprehensive upskilling and reskilling programs must address five emerging competencies: digital fluency across all functions, adaptability and agility for navigating uncertainty, creative problem-solving as AI handles routine tasks, cross-functional collaboration across departments and geographies, and leadership capabilities for hybrid work environments. Companies implementing structured learning programs report 40% increases in employee engagement and a measurable improvement in their capacity to fill critical skill gaps internally rather than through external recruitment.

Personalised learning platforms powered by AI enable organisations to deliver targeted development at scale. Rather than one-size-fits-all training, adaptive systems tailor content to individual employee needs, career trajectories, and learning preferences, maximising engagement and impact. Microlearning approaches that deliver short, focused sessions integrate development into daily workflows without disrupting productivity. Amazon's $1.2 billion Career Choice Programme and Siemens' global learning ecosystem exemplify large-scale implementations that prepare workforces for technology-driven futures.

8.3 External Talent Market Opportunities

Externally, corporate training and development services meet surging demand from organisations that recognise upskilling imperatives but lack internal capabilities to design and deliver effective programs. Training providers specialising in digital skills, AI literacy, data analytics, and leadership development for distributed teams can build substantial businesses serving corporate clients. The most successful providers combine subject matter expertise with learning science, delivering measurable skill development rather than simply providing content.

Talent marketplace platforms that connect skilled professionals with project-based opportunities address both workforce flexibility needs and individual career development goals. As organisations shift from permanent headcount models to more flexible talent strategies, platforms facilitating fractional work, interim leadership, and specialised expertise placements create value for both companies and professionals.

9. Supply Chain Resilience and Operational Excellence

9.1 The Resilience Imperative

Supply chain disruptions from COVID-19, geopolitical tensions, and climate events have elevated resilience from nice-to-have to business-critical capability. Organisations with resilient supply chains—characterised by agility, visibility, diversification, and collaboration—minimise disruption impacts, maintain business continuity, and achieve 20-30% lower long-term supply chain costs compared to less resilient competitors.

9.2 Internal Supply Chain Initiatives

Internally, supply chain diversification strategies reduce over-reliance on single suppliers, vendors, or trade routes, thereby reducing vulnerability to regional disruptions. Dual sourcing—acquiring products from two suppliers—and "supplier +1" strategies that maintain backup options provide continuity when primary sources face challenges. While diversification introduces complexity and potentially higher costs, these investments prove worthwhile when disruptions occur. Apple's expansion of production beyond China to India, Vietnam, and other Southeast Asian countries exemplifies successful diversification that maintains supply continuity while managing geopolitical risk.

Digital supply chain transformation enabled by IoT, predictive analytics, and AI provides real-time visibility and proactive management. IoT sensors provide shipment tracking, environmental monitoring, and delivery status updates, while AI-powered analytics predict disruptions based on weather patterns, political events, and demand fluctuations. This shift from reactive to predictive supply chain management reduces costs, improves customer satisfaction, and creates competitive advantages.

9.3 External Supply Chain Opportunities

Externally, supply chain technology and consulting services help organisations build resilience capabilities. Companies providing supply chain visibility platforms, predictive analytics tools, risk assessment services, and diversification strategy consulting address pressing client needs. The most valuable providers combine technology implementation with strategic advisory, helping clients redesign supply chain networks for resilience while maintaining cost efficiency.

Logistics innovation and last-mile delivery solutions capitalise on e-commerce growth and consumer expectations for fast, flexible delivery. Autonomous vehicles, drone delivery systems, smart routing algorithms, and micro-fulfilment centres represent technology frontiers where innovation creates competitive advantage. Companies solving last-mile challenges—the most expensive and complex segment of the supply chain—create substantial value for clients while building defensible market positions.

Summary of the Eight Opportunities

|

Opportunity Area |

Growth Rate (CAGR %) |

Investment Priority |

Internal Focus |

External Focus |

Time to Impact |

|

AI & Automation |

30 |

Critical |

Process automation, AI integration |

AI consulting services, product innovation |

6-12 months |

|

Sustainability & ESG |

15 |

High |

ESG reporting, sustainable operations |

Green products, circular economy |

12-24 months |

|

Digital Transformation |

18 |

Critical |

Infrastructure modernisation, data systems |

Cloud services, digital channels |

6-18 months |

|

Emerging Markets |

12 |

High |

Market research, local partnerships |

Geographic expansion, new customers |

18-36 months |

|

Customer Experience |

14 |

High |

CX analytics, personalisation |

Customer engagement platforms |

6-12 months |

|

Strategic Partnerships |

16 |

Medium |

Cross-functional collaboration |

Joint ventures, alliance networks |

12-24 months |

|

Workforce Development |

13 |

High |

Upskilling programs, talent retention |

External training partnerships |

12-18 months |

|

Supply Chain Resilience |

11 |

Medium |

Supplier diversification, risk mitigation |

Technology partnerships, diversification |

12-24 months |

10. Implementation Framework: From Strategy to Execution

10.1 The Three-Phase Approach

Successful opportunity capture requires structured implementation spanning three phases over the 2025-2028 timeframe. Phase One (Months 1-12) focuses on foundation building: conducting skills gap analyses, implementing pilot programs in high-impact areas, establishing measurement frameworks, and securing quick wins that demonstrate value and build organisational momentum. Organisations should prioritise 2-3 opportunity areas aligned with strategic objectives rather than attempting transformation across all domains simultaneously.

Phase Two (Months 13-24) emphasises scaling and refinement: expanding successful pilots to broader organisational deployment, integrating technologies and processes across functions, developing external market offerings based on internal capabilities, and establishing partnership ecosystems that accelerate growth. This phase requires sustained executive commitment and change management to overcome inevitable resistance and implementation challenges.

Phase Three (Months 25-36) delivers full transformation: achieving company-wide adoption of new capabilities, launching new products and services into external markets, establishing leadership positions in chosen opportunity domains, and creating self-reinforcing ecosystems that generate ongoing innovation. Success in this phase positions organisations for sustained competitive advantage beyond the initial three-year horizon.

10.2 Critical Success Factors

Five factors determine the success of transformation across all opportunity areas. Executive leadership and governance provide vision, resources, and accountability essential for sustained transformation efforts. Without C-suite commitment, initiatives fragment into disconnected projects that fail to achieve strategic impact. Data-driven decision-making ensures investments target the highest-value opportunities and that course corrections occur based on performance rather than assumptions. Cultural transformation and change management address the human dimensions that often derail technically sound strategies. Balanced internal-external focus builds capabilities that simultaneously improve operations and create market offerings. Finally, continuous learning and iteration enable organisations to adapt as technologies evolve and market conditions shift.

11. Seizing the Transformation Decade

The 2025-2028 period represents a pivotal transformation window where the convergence of artificial intelligence, digital infrastructure, sustainability imperatives, and evolving market dynamics creates unprecedented business opportunities. Organisations that successfully navigate this landscape will achieve a competitive advantage that extends far beyond the three-year planning horizon. The key lies not in pursuing all opportunities simultaneously but in strategically selecting 3-5 areas aligned with organisational strengths and market positioning, then executing with discipline across both internal capability building and external market development.

The most successful companies will adopt ambidextrous strategies: optimising current operations through automation and digital transformation while simultaneously exploring new business models, markets, and ecosystems. They will balance short-term quick wins that fund ongoing transformation with long-term capability building that positions them for sustained leadership. And they will recognise that competitive advantage increasingly flows not from proprietary technologies but from organisational capabilities—the ability to learn faster, adapt more quickly, and execute more effectively than competitors.

The question facing business leaders is not whether to transform but how comprehensively and quickly to act. The opportunities outlined in this report collectively represent trillions in value creation potential, but that value will accrue disproportionately to first movers and fast followers who execute decisively. Organisations that delay transformation face not just missed opportunities but existential threats as more agile competitors capture markets, talent, and mindshare. The imperative is clear: begin immediately with focused pilots, scale rapidly based on results, and commit to sustained transformation that positions the organisation for leadership in the emerging business landscape.

References:

- https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Marketing%20and%20Sales/Our%20Insights/The%20new%20growth%20game/The-new-growth-game-Web.pdf

- https://www.linkedin.com/pulse/top-10-fastest-growing-industries-2025-cagr-data-trx5c

- https://www.thestrategyinstitute.org/insights/the-role-of-ai-in-business-strategies-for-2025-and-beyond

- https://www.qmarkets.net/resources/article/digital-transformation-strategy/

- https://www.pwc.com/us/en/tech-effect/ai-analytics/ai-predictions.html

- https://osher.com.au/blog/roi-business-process-automation-comprehensive-guide/

- https://www.movantech.com/blog/business-process-automation-in-2025-maximizing-roi-through-smart-implementation

- https://www.shopify.com/blog/business-opportunities

- https://www.ptc.com/en/blogs/corporate/digital-transformation-strategy

- https://ifza.com/en/top-innovative-business-ideas-uae-2025/

- https://www.planview.com/resources/guide/definitive-digital-transformation-guide/digital-transformation-strategy/

- https://www.statsig.com/perspectives/unleashing-big-data-advantage

- https://www.forbes.com/sites/forbestechcouncil/2018/07/18/analytics-are-a-source-of-competitive-advantage-if-used-properly/

- https://www.startupwars.com/fastest-growing-industries/

- https://lumenalta.com/insights/how-to-build-a-digital-transformation-strategy-roadmap

- https://www.market-xcel.com/us/blogs/fastest-growing-industries-usa

- https://www.fuqua.duke.edu/programs/executive-education/leading-global-business-strategy/emerging-market-outlook

- https://ifza.com/en/green-business-ideas-dubai-2025/

- https://www.imd.org/ibyimd/2025-trends/sustainability-trends-businesses-must-watch-in-2025/

- https://www.thomsonreuters.com/en-us/posts/esg/2025-predictions/

- https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/insights/long-term-value/documents/ey-gl-the-future-of-sustainability-in-business-why-success-depends-on-integration-05-2025.pdf

- https://avyanco.com/news/business-ideas-in-dubai-uae/

- https://www.uschamber.com/co/start/business-ideas/top-trending-business-ideas

- https://www.sprinklr.com/blog/customer-experience-roi/

- https://www.qualtrics.com/articles/customer-experience/customer-experience-roi/

- https://inmoment.com/blog/customer-experience-roi/

- https://www.forrester.com/report/The-ROI-Of-CX-Transformation/RES136233

- https://www.triodos-im.com/articles/2025/emerging-markets-mid-year-2025-investment-outlook

- https://www.wisdomtree.com/investments/blog/2025/04/03/whats-hot-and-whats-not-in-emerging-markets-so-far-in-2025

- https://www.meegle.com/en_us/topics/market-entry-strategy/market-entry-strategy-for-emerging-markets

- https://www.filuet.com/blog/global-market-expansion-strategies-from-emerging-economies-to-mature-markets

- https://www.logisticsexecutive.com/insights_advisory/expanding-horizons/

- https://www.simon-kucher.com/en/insights/how-strategic-partnering-can-fuel-better-business-growth

- https://www.thepolyglotgroup.com/blog/building-strong-partnerships-alliances-for-business-growth/

- https://www.primeit.ch/en/the-role-of-strategic-partnerships-in-global-business-expansion/

- https://www.forbes.com/councils/forbesbusinesscouncil/2024/11/26/the-power-of-strategic-partnerships-driving-business-growth-through-collaboration/

- https://www.bcg.com/publications/2025/middle-east-powered-by-ambition-building-lasting-innovation-ecosystems

- https://www.wipo.int/en/web/global-innovation-index/2025/index

- https://hortoninternational.com/upskilling-in-2025/

- https://skillsdb.com/blog/upskilling-2025-future-of-work

- https://eightfold.ai/wp-content/uploads/hr-coms-future-of-upskilling-and-employee-learning.pdf

- https://www.weforum.org/publications/the-future-of-jobs-report-2025/digest/

- https://www.sap.com/products/scm/integrated-business-planning/what-is-a-resilient-supply-chain.html

- https://imtek.ca/how-digital-transformation-is-shaping-the-future-of-supply-chain-resilience/

- https://www.l2l.com/blog/supply-chain-resilience-strategies

- https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2020/06/building-supply-chain-resilience-through-digital-transformation.pdf

- https://b-plannow.com/en/30-innovative-business-ideas-to-be-launched-in-2025/

- https://www.studocu.com/en-gb/messages/question/9625373/business-report-1000-wordsin-the-role-of-a-management-consultant-you-are-invited-by-the

- https://www.iese.edu/media/research/pdfs/ESTUDIO-137.pdf

- https://www.investopedia.com/articles/personal-finance/090815/basics-business-development.asp

- https://www.scribd.com/document/598272303/B-ST-case-study-class-12-converted

- https://writemyessay.co.uk/free_resource/international-business-report-1500-words/

- https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/programs/cri/files/ExpandingOpportunity+(fullreport).pdf

- https://abzi.ae/business-opportunities-in-the-uae/

- https://www.goldmansachs.com/insights/articles/emerging-markets-stocks-and-currencies-are-forecast-to-rally

- https://www.hubspot.com/startups/reports/hypergrowth-startups/fastest-growing-industries

- https://dmcc.ae/blog/top-business-opportunities-in-dubai

- https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work

- https://www.vegam.ai/business-process-automation/roi

- https://mlq.ai/media/quarterly_decks/v0.1_State_of_AI_in_Business_2025_Report.pdf

- https://camunda.com/blog/2024/06/the-roi-of-automation-understanding-the-impact-on-your-business/

- https://www.abudhabichamber.ae/en/media-centre/news/Abu-Dhabi-Chamber-Abu-Dhabi-AI-sector-expands-2025

- https://www.safeguardglobal.com/resources/blog/benefits-of-expanding-into-new-markets/

- https://www.keyesg.com/article/50-esg-statistics-you-need-to-know

- https://news.sap.com/india/2021/12/create-competitive-advantage/

- https://www.deloitte.com/nl/en/services/consulting/blogs/building-a-competitive-advantage-through-analytics.html

- https://learning.linkedin.com/resources/workplace-learning-report

- https://www.bls.gov/opub/mlr/2023/beyond-bls/hybrid-work-seems-to-be-working-out-just-fine.htm

- https://archieapp.co/blog/hybrid-workplace-stats/

- https://www.hr-consulting-group.com/hr-news/hybrid-work-optimization

- https://www.linezero.com/blog/the-flexible-hybrid-work-environment